A Comprehensive Guide to HVAC Financing for Homeowners

Why HVAC Financing Matters for Homeowners

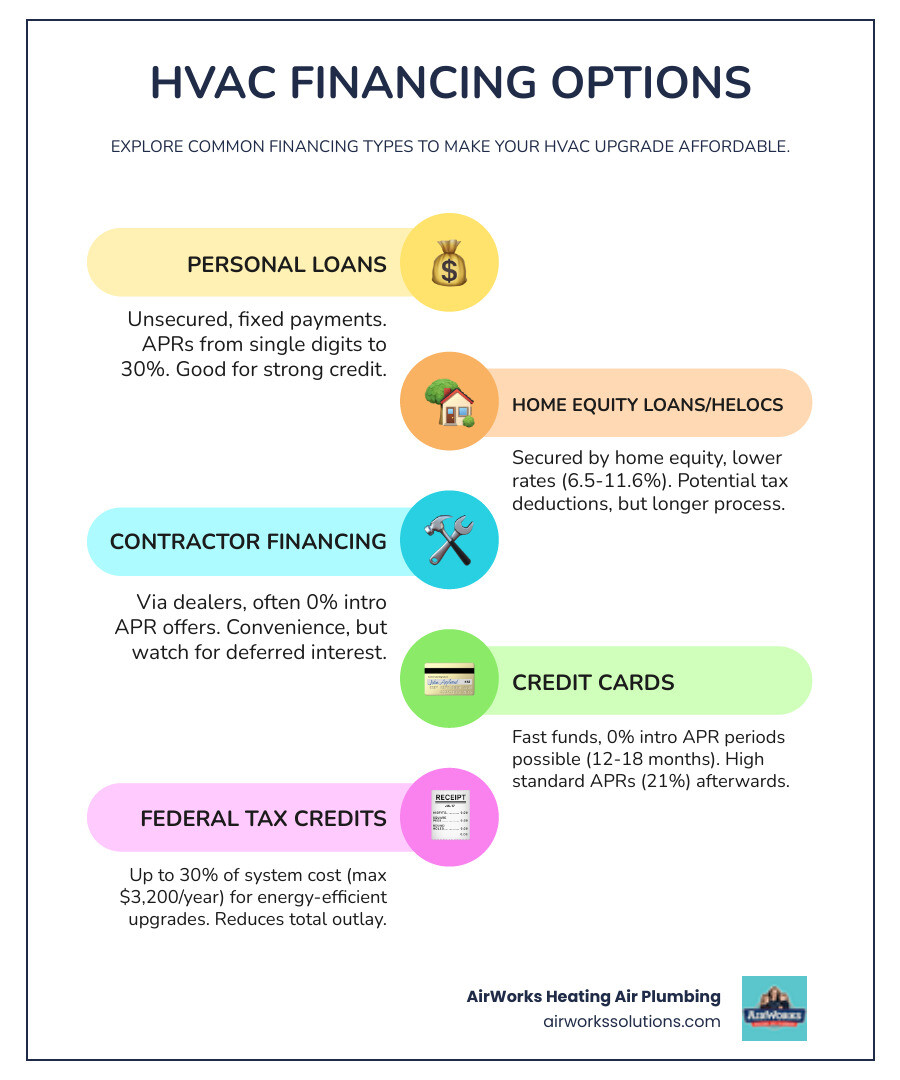

HVAC financing options for homeowners make it possible to replace or upgrade your heating and cooling system without paying the full cost upfront. Here are the main ways to finance a new HVAC system:

- Personal Loans: Unsecured loans with fixed payments, often with APRs ranging from single digits to 30%

- Home Equity Loans/HELOCs: Secured by your home equity, typically offering lower interest rates (6.5% to 11.6%)

- Contractor Financing: Offered through HVAC dealers, often with promotional 0% APR periods for qualified buyers

- Credit Cards: Quick access to funds with 0% intro APR periods (12-18 months), but high standard APRs around 21%

- Federal Tax Credits: Up to 30% of system cost (maximum $3,200 per year) for energy-efficient upgrades

- State and Utility Rebates: Cash-back incentives that vary by location

When your air conditioner breaks down in the middle of summer or your furnace fails during a cold snap, you need a solution fast. But a new HVAC system can cost upwards of $19,000 or more for an average home. Most families don't have that kind of cash sitting in savings, and tapping your emergency fund can leave you vulnerable to other unexpected expenses. That's where HVAC financing comes in. It bridges the gap between needing immediate comfort and managing your budget responsibly, allowing you to spread the cost over time while still getting the reliable heating and cooling your family deserves.

If you're considering an upgrade to your heating and air conditioning system, explore our guide to HVAC system replacements or contact us for a free consultation.

I'm Stephanie Allen, CEO of AirWorks Heating Air Plumbing, and over the years I've helped countless homeowners steer HVAC financing options for homeowners in Ventura County and beyond, making essential upgrades accessible without compromising financial stability. My goal is to help you understand your options so you can make the best choice for your family's comfort and budget.

Understanding the Main Types of HVAC Financing

This section will explore the most common ways homeowners can pay for a new heating and cooling system over time, breaking down the advantages and disadvantages of each.

We know that getting a new HVAC system is a significant investment. Few homeowners have the cash readily available to cover the entire cost upfront, especially when an unexpected breakdown forces an immediate replacement. That's why understanding the various HVAC financing options for homeowners is so crucial. These options allow you to enjoy a comfortable home now while managing the expense over time. Let's break down the most common types of financing available.

| Financing Option | Interest Rate (APR) | Loan Term | Collateral | Pros We will now answer the question: How Does HVAC Financing Work?

Personal Loans

Personal loans are a popular option for HVAC financing options for homeowners because they are unsecured, meaning you don't have to put up your home or other assets as collateral. You receive a lump sum of money and repay it over a set period with fixed monthly payments. This predictability can be a huge relief, allowing you to budget effectively. Interest rates for personal loans can vary significantly, ranging from single digits to around 30% APR, depending on your credit score and the lender. For those with strong credit, you might secure a very favorable rate. In February 2025, the average interest rate on a 24-month personal loan was about 11.7%. We often recommend exploring personal loans from your bank, a local credit union, or an online lender for their flexibility and relatively quick approval process. For more details on personal loans, you can refer to this Investopedia guide.

Home Equity Loans and HELOCs

If you've built up significant equity in your home, a home equity loan or a Home Equity Line of Credit (HELOC) can be attractive HVAC financing options for homeowners. These are secured loans, meaning your home serves as collateral. The upside is that because they're secured, they typically come with lower interest rates compared to unsecured personal loans. We've seen rates commonly ranging from 6.5% to 11.6%. An added benefit is that the interest on these loans may be tax-deductible if the funds are used for home improvements, which an HVAC upgrade certainly qualifies as. You can learn more about the potential deduction of home equity interest from the IRS. The downside is that the application process can be longer and more involved, and defaulting on the loan could put your home at risk. For a deeper dive into home equity loans, check out this Consumer Financial Protection Bureau resource.

Contractor and Manufacturer Financing

Many HVAC dealers, including us, offer financing directly through partnerships with third-party lenders. These options are incredibly convenient, as you can often apply and get approved right when you're getting a quote for your new system. A significant draw for this type of financing is the frequent availability of promotional offers, such as 0% APR for a specific period (e.g., 60 months for qualified buyers). However, it's crucial to understand the terms of these "deferred interest" promotions. If you don't pay off the entire balance before the promotional period ends, you could be hit with all the accrued interest from day one, often at a very high rate (e.g., 28.99% APR). Always read the fine print! Some common lenders our customers use include Wells Fargo for home projects. For those with less-than-perfect credit or unique situations, some providers like Microf offer rent-to-own options, which can provide a path to a new system when other financing isn't accessible.

Credit Cards

Using a credit card for your HVAC purchase offers quick access to funds, which can be invaluable in an emergency. Many credit cards also feature introductory 0% APR periods, typically lasting from 12 to 18 months. If you're confident you can pay off the balance within this interest-free window, a credit card can be a smart, short-term financing solution. However, be wary of the average credit card APR, which hovers around 21%. If you carry a balance beyond the promotional period, the interest can quickly add up, making your new HVAC system much more expensive. Plus, a large purchase can significantly impact your credit utilization ratio, potentially lowering your credit score. We generally recommend credit cards for smaller repairs or if you have a clear plan to pay off the balance quickly.

Maximizing Savings with Rebates, Tax Credits, and Incentives

Financing covers the upfront cost, but incentives can significantly lower the total amount you need to borrow. Understanding these programs is key to making your upgrade more affordable.

Beyond the direct financing options, there's a world of savings available to homeowners who choose energy-efficient HVAC systems. These incentives, often in the form of rebates and tax credits, can dramatically reduce the net cost of your investment, making those monthly payments even more manageable. We encourage all our clients in the Sacramento and Ventura County areas to explore these opportunities, as they can put a surprising amount of money back in your pocket. For a general overview of available financial assistance, you can refer to the Department of Energy's guide on Financing and Incentives.

The Role of Federal Tax Credits

The federal government is keen on encouraging homeowners to make energy-efficient upgrades, and they put their money where their mouth is! Through the Energy Efficient Home Improvement Credit, you can claim 30% of your system’s cost on your federal taxes. There's an annual limit of up to $3,200 for all qualified energy-efficient home improvements. For specific high-efficiency equipment like heat pumps, you can claim up to $2,000 per year. This program is set to run through 2032, offering a fantastic opportunity to save. To claim these credits, you'll generally need to meet specific IRS requirements and submit IRS Form 5695 with your tax return. Always keep detailed receipts for your equipment and installation!

State, Local, and Utility Rebates

While federal tax credits are a big help, don't overlook the incentives available closer to home. Many state and local governments, as well as utility providers, offer cash-back rebates for installing energy-efficient HVAC systems. These programs vary widely by location and change frequently, so it's always a good idea to check what's available in your specific area. For example, local electric or gas providers in California might offer rebates for high-SEER air conditioners or efficient furnaces. We often guide our clients to check with their local utility companies or visit resources like the Department of Energy's Home Upgrades section, which can point you toward regional programs. The ENERGY STAR website also provides information on Federal Tax Credits for Energy Efficiency that might link to local offerings.

Tax Credit vs. Rebate: What's the Difference?

It's easy to confuse tax credits and rebates, but understanding the distinction can help you maximize your savings. A tax credit directly reduces the amount of income tax you owe. If you owe $1,000 in taxes and get a $500 tax credit, your tax bill drops to $500. A rebate, on the other hand, is usually a direct discount or cash back on your purchase. You receive the money directly from the utility company, manufacturer, or local program. Both effectively lower the net cost of your HVAC system, but they work differently. We find that combining both can lead to substantial savings, making that new high-efficiency system even more attractive. For more on this, the Department of Energy has a helpful page titled Making Our Homes More Efficient: Energy Tax Credits for Consumers.

Navigating the Best HVAC financing options for homeowners

Once you understand your options, the next step is to choose a plan and steer the application process. Here’s what you need to know to secure the right financing for your needs.

Choosing the right HVAC financing options for homeowners can feel like navigating a maze, but with the right information, it becomes much simpler. Our goal is to empower you to make an informed decision that best suits your financial situation and comfort needs.

Key Factors to Consider When Choosing a Plan

When evaluating different financing plans, we always advise our clients to look beyond just the monthly payment. Here are the crucial factors to consider:

- Interest Rates (APR): This is the cost of borrowing money, expressed as an annual percentage. A lower APR means you'll pay less interest over the life of the loan.

- Loan Terms: How long will you be making payments? Longer terms mean lower monthly payments but typically more interest paid overall. Shorter terms mean higher monthly payments but less total interest.

- Monthly Payment Amount: Can you comfortably afford the payment without straining your budget? We recommend ensuring it fits well within your monthly expenses.

- Fees and Penalties: Look out for origination fees, application fees, or prepayment penalties if you plan to pay off the loan early.

- Lender Reputation: Choose a reputable lender with clear terms and good customer service. Our relationships with trusted financing partners mean we can connect you with reliable options.

For more insights on making this choice, you can consult a guide on the Best Ways to Finance a New HVAC System: A Homeowner’s Guide.

The HVAC Financing Process: From Application to Installation

The journey from a broken HVAC system to a comfortable home, financed responsibly, typically follows a few key steps:

- Getting Quotes: First, you'll get detailed quotes for your new HVAC system from qualified contractors. This helps you understand the total cost.

- Choosing a Lender: Based on your research and our recommendations, you'll select the financing option that best fits your needs.

- Submitting an Application: You'll fill out a financing application, which can often be done online or over the phone. This typically requires basic personal and financial information.

- Approval and Review: The lender will review your application. Approval can sometimes happen in minutes, or it might take a couple of days. Once approved, carefully review the loan terms before signing.

- Scheduling Installation: With financing secured, we can schedule your HVAC installation at your convenience.

- Making Payments: Once your system is installed, you'll begin making your agreed-upon monthly payments.

Preparing for Your HVAC Financing Application

To ensure a smooth and quick application process, we recommend having a few things ready:

- Gathering Documents: This often includes proof of income (pay stubs, tax returns), photo identification, and proof of residency.

- Property Information: If applying for a home equity loan, you'll need details about your home and mortgage.

- Credit History Check: It's a good idea to know your credit score beforehand. This can help you anticipate what interest rates you might qualify for and which financing options are most suitable.

- Contractor Quotes: Have your detailed HVAC installation quotes handy, as lenders may ask for them.

Special Financing Scenarios and Considerations

Not every homeowner's situation is the same. This section covers specific financing circumstances, including options for different credit profiles and geographic locations.

We understand that every homeowner's financial journey is unique. That's why we believe in exploring all avenues to ensure you get the reliable heating and cooling you deserve, regardless of your credit score or location.

HVAC financing options for homeowners with Bad Credit

Having a less-than-perfect credit score doesn't mean you're out of options for HVAC financing options for homeowners. While you might not qualify for the lowest interest rates or 0% APR promotions, there are still paths forward:

- Subprime Contractor Financing: Some HVAC contractors work with lenders who specialize in financing for individuals with lower credit scores. Expect higher interest rates and potentially shorter repayment terms.

- Secured Loans: If you have an asset you're willing to use as collateral (like a car or other property), a secured personal loan might be an option, though we generally advise caution when securing loans with personal assets.

- Rent-to-Own Programs: Services like Microf, mentioned earlier, offer rent-to-own or lease-to-own agreements. While you don't own the system outright initially, it allows you to get a new unit and potentially purchase it later.

- Government Assistance Programs: For eligible low-income households, programs like the Low Income Home Energy Assistance Program (LIHEAP) in the U.S. can provide financial assistance for home heating and cooling energy costs, bill payment assistance, and even energy crisis assistance. This isn't direct financing for a new system, but it can help manage energy bills, freeing up funds for other expenses.

HVAC financing options for homeowners in the US

For our valued clients in the greater Sacramento area and Ventura County, we focus on HVAC financing options for homeowners available here in California and across the United States.

- Federal Tax Credits: As discussed, federal tax credits are a significant benefit for energy-efficient upgrades, available nationwide.

- LIHEAP: This federal program helps low-income households manage their energy bills, which can indirectly assist with affording HVAC upgrades by easing other financial burdens. You can use their tool to find help with your energy bills.

- State and Local Programs: California often has its own energy efficiency programs, rebates, and sometimes even loan programs for homeowners. These can vary by county or city, so we always recommend checking with your local energy agencies and utility providers. For example, our 'Go Green Loan' is an unsecured loan developed by the State of California to offer financing for residential energy upgrades with approved contractors. Additionally, our 'Eco-Friendly Loan' through Travis Credit Union helps finance various residential energy upgrades.

Please note: While our research included some Canadian-specific programs like the Canada Greener Homes Loan or those offered by FinanceIT and SNAP Home Finance, these are not applicable to our service areas in California.

Long-Term Benefits of Financing an Energy-Efficient System

Beyond the immediate comfort and spread-out payments, choosing to finance an energy-efficient HVAC system offers substantial long-term benefits:

- Immediate Energy Savings: Modern, energy-efficient units consume significantly less power. This means lower monthly utility bills right from the start, helping to offset your financing payments.

- Improved Home Comfort: New systems offer more consistent temperatures, better humidity control, and quieter operation, changing your home into a true sanctuary.

- Increased Property Value: An updated, energy-efficient HVAC system is a major selling point and can increase the overall value of your home.

- Positive Environmental Impact: By reducing your energy consumption, you're also lowering your carbon footprint, contributing to a healthier planet.

Frequently Asked Questions about HVAC Financing

We often get asked similar questions about financing, and we're happy to provide clear answers to help you feel confident in your decisions.

What credit score is typically needed to qualify for HVAC financing?

The credit score needed for HVAC financing options for homeowners can vary quite a bit depending on the type of loan and the lender. Generally, a good to excellent credit score (typically 690 or higher) will qualify you for the most favorable terms, including the lowest interest rates and those attractive 0% APR promotional offers. However, don't despair if your score isn't in that range. Many lenders and contractor financing programs offer options for individuals with fair or even poor credit, though these usually come with higher interest rates or different terms. It's always best to check your credit score before applying so you know what to expect.

What are the potential risks to watch out for when considering HVAC financing?

While financing makes a new HVAC system accessible, it's wise to be aware of potential pitfalls. The biggest one we see is with "deferred interest" promotional offers, especially from contractor financing or credit cards. If you don't pay off the entire balance before the promotional period ends, you could be charged all the interest that accumulated from the original purchase date, often at a very high APR. Another risk is prepayment penalties, which some loans might impose if you pay off your balance early. For home equity loans or HELOCs, the risk involves using your home as collateral; defaulting could put your property at risk. We always stress the importance of reading the fine print and understanding all terms and conditions before signing any agreement.

How can I find a participating HVAC dealer or contractor that offers financing?

Finding an HVAC dealer that offers financing is usually quite straightforward. Most reputable companies, like AirWorks Heating Air Plumbing, clearly advertise their financing options on their websites. You can often find dedicated financing pages that outline the partners they work with and the types of plans available. When you request a quote for a new system, simply ask your contractor about their financing options. We're always happy to walk you through the choices we provide. Keep an eye out for logos of well-known financing partners such as Wells Fargo or Synchrony Bank on a contractor's website or in their office, as these indicate established financing relationships.

Conclusion

Choosing the right HVAC financing makes a crucial home upgrade affordable and accessible. By exploring personal loans, contractor plans, and home equity options, and by leveraging valuable tax credits and rebates, you can install a modern, energy-efficient system without depleting your savings. This investment not only ensures immediate comfort but also provides long-term savings on your energy bills. For homeowners in the greater Sacramento area, the team at AirWorks Heating Air Plumbing can help you steer these options to find a solution that fits your budget and needs. Learn more about our AC installation services.

.webp)